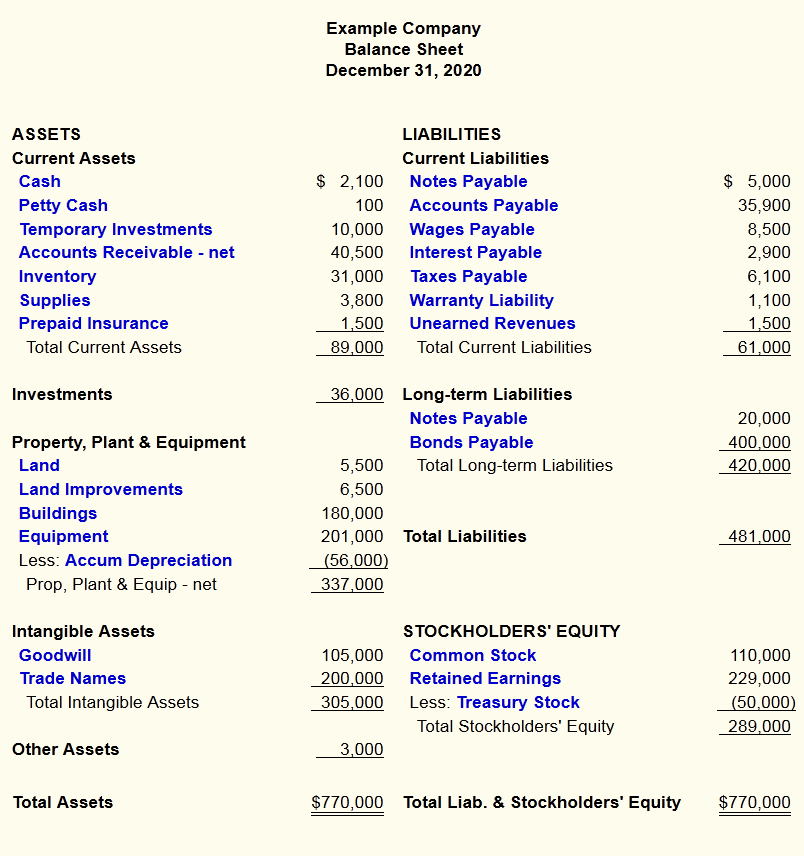

For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. This may include accounts payables, rent and utility payments, current debts or notes payables, current portion of long-term debt, and other accrued expenses. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years. Unlike the asset and liability sections, the equity section changes depending on the type of entity. For example, corporations list the common stock, preferred stock, retained earnings, and treasury stock.

Profit and Loss Statement (Income Statement)

To judge leverage, you can compare the debts to the equity listed on your balance sheet. Leverage can also be seen as other people’s money you use to create more assets in your business. In addition to our balance sheet templates, our business forms also offer templates for the income statement, statement of cash flows, and more. Do you want to learn more about what’s behind the numbers on financial statements? Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential. In the asset sections mentioned above, the accounts are listed in the descending order of their liquidity (how quickly and easily they can be converted to cash).

Assessing balance sheets for growth

The second source of funding—other than liabilities—is shareholders equity (or “stockholders equity”), which consists of the following line items. The next section consists of non-current assets, which are described in the table below. Once complete, we’ll undergo an interactive events spotlight training exercise in Excel, where we’ll practice building a balance sheet template using the historical data pulled from the 10-K filing of Apple (AAPL). After you’ve identified your reporting date and period, you’ll need to tally your assets as of that date.

Great! The Financial Professional Will Get Back To You Soon.

Different industries, and therefore different companies, may have slight variations in reporting standards. Looking under the surface of these figures lets analysts and investors see how the business is doing financially, and compare one company to another. The balance sheet gives useful insights into a company’s finances.

- This financial statement is used both internally and externally to determine the so-called “book value” of the company, or its overall worth.

- Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

- Get instant access to video lessons taught by experienced investment bankers.

- The financial statement only captures the financial position of a company on a specific day.

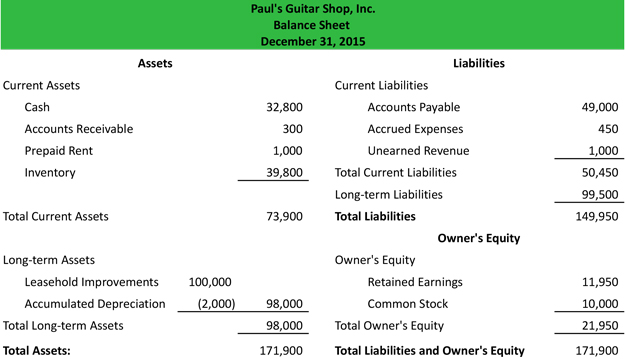

He doesn’t have a lot of liabilities compared to his assets, and all of them are short-term liabilities. Annie’s Pottery Palace, a large pottery studio, holds a lot of its current assets in the form of equipment—wheels and kilns for making pottery. You can improve your current ratio by either increasing your assets or decreasing your liabilities. Ecord the account name on the left side of the balance sheet and the cash value on the right. Activity ratios mainly focus on current accounts to reveal how well the company manages its operating cycle.

Take stock, calmly

The balance sheet of Apple (AAPL), a global consumer electronics and software company, for the fiscal year ending 2021 is shown below. Assets describe resources with economic value that can be sold for money or have the potential to provide monetary benefits someday in the future. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. Updates to your enrollment status will be shown on your account page.

In these instances, the investor will have to make allowances and/or defer to the experts. All programs require the completion of a brief online enrollment form before payment. If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice. Explore our online finance and accounting courses, which can teach you the key financial concepts you need to understand business performance and potential. To get a jumpstart on building your financial literacy, download our free Financial Terms Cheat Sheet. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand.

Maintaining your business’s financial health is a key component of long-term success. Utilizing tools like the balance sheet and other financial statements will help you keep your finances in check. The balance sheet, income statement, and cash flow statement make up the three main financial statements that businesses use.