Not exactly. Each of these is a great start to your own financial procedure (you to definitely finishes that have a full acceptance to invest in a property). But one is much more serious compared to the most other when you get alongside to purchase a property. Let’s establish.

Share this article

If you would like a mortgage to order a house – means before you set a deal, you want a lender onboard that will financing you the money.

Thus, exactly what do you ought to start their processes, of course, if? You to hinges on whether you’re during the early level off believe to order a house, or around to visit house-search.

Pre-meet the requirements to acquire set:

- The ability to apply at their specialist TNM representative to know how mortgage loans works and exactly what financial details you will need to has in place

- A good ballpark concept of just what house price plus exactly what neighbourhood you might get

- And therefore bank and you will mortgage circumstances may be best for your situation

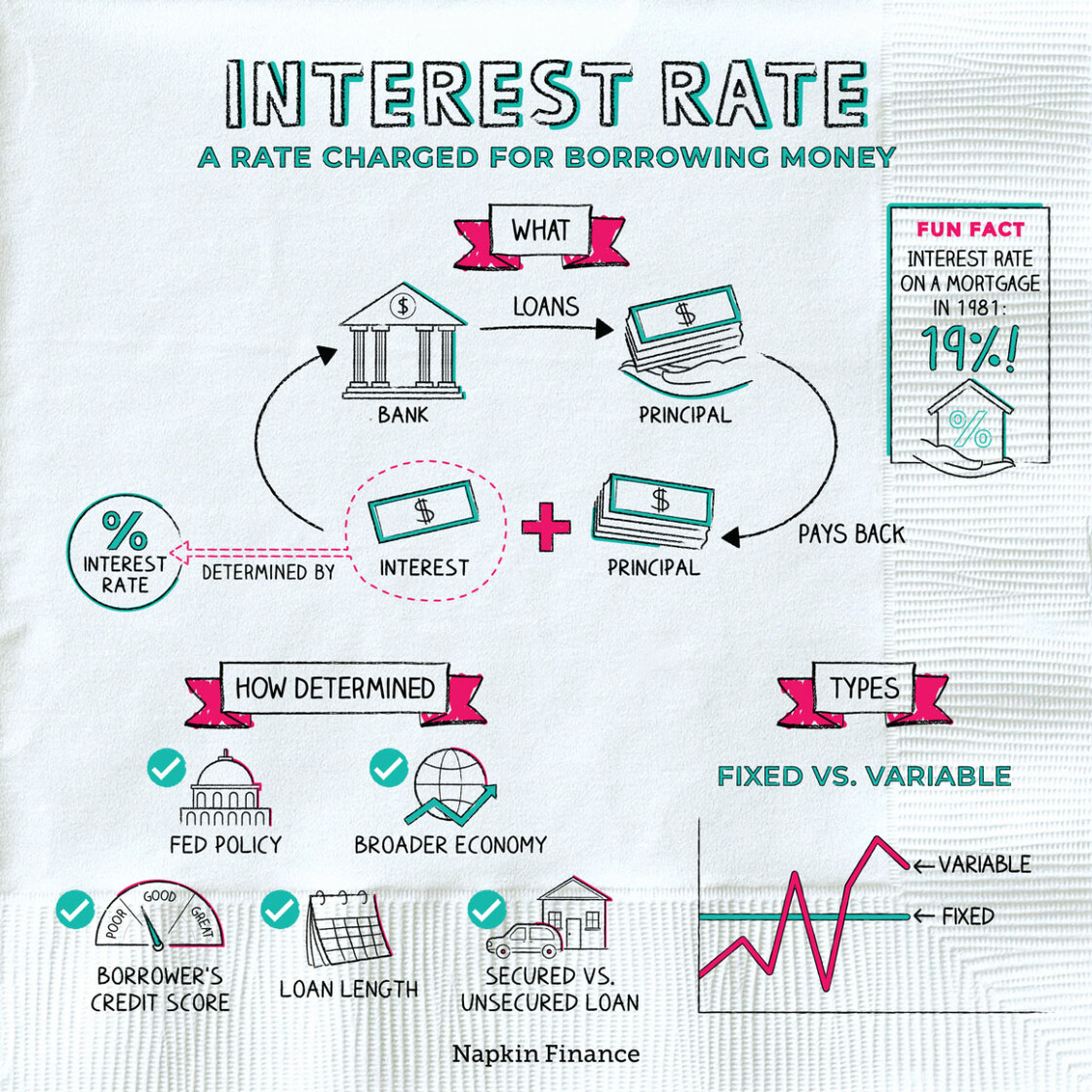

- A sense of the pace-method of and label that can benefit your finances (age.g. how can i all the way down my personal mortgage payments?)

- The ability to comment otherwise adjust your current cash, and having your deposit together, or boosting your credit history

Pre-approve discover big:

- A very accurate notion of the dimensions of home loan you can afford (you can promote a whole lot more monetary recommendations compared to a pre-qualify)

- The lender and mortgage types of that is best for your situation

- The capacity to hold your best rates for approximately 120 months (a credit check is accomplished from the financial to be certain the standing)

- New financial parts in place you need to take absolutely by the real estate professionals and you may manufacturers

Some of the clients disregard directly to good pre-acceptance, in order for these are typically in a position and put to place a deal toward a property.

Not all of our subscribers score pre-qualified very first. In reality, it is more about as to whether or not an excellent pre-qualify is best match, or if i circulate best to come to help you an effective pre-recognition.

For people who e mail us at part as you prepare so you can go searching, or perhaps you even have a home in your mind, the Genuine Northern Large financial company does a pre-acceptance, that americash loans in Red Feather Lakes has a credit assessment and you may rates keep, to easily rating everything in set – also to let assure that you’re getting the credit you need.

You should know: Neither good pre-be considered neither a pre-recognition are an actual ensure of a lender. The latest ‘pre’ region becomes your as near to to your number the lender will actually approve, to domestic-store with more believe.

The full financial approval is when you have, at your fingertips, your own approved (constantly conditional) give towards the property. Their TNM agent will assist execute everything, and you can description all history closure pricing, doing your completely-approved mortgage app. One last approval will be based to your financial info and you will docs given, and the family you happen to be to purchase.

What happens easily put an offer whenever I have only already been pre-licensed?

For individuals who skip the pre-acceptance action, this may indicate that you take a lot more of a risk given that so you can whether or not you’ll be able to in reality be tested on a loan provider. Actually, many realtors and you may providers strongly choose that you will get completely pre-acknowledged, to help make the revenue wade simpler with faster options one you’ll be rejected your own home loan app (and just have to begin with over again with a unique home).

How much time do often financial processes take?

Because the an excellent pre-meet the requirements need shorter economic facts and you will does not cover a credit assessment, it could take one of the expert Real Northern Home loans only a few moments to dictate their crude mortgage-cost.

Grab a go with the help of our Financial Affordability calculator to acquire specific ballpark quantity, following give us a scream or implement on the web to suit your facts.

If you wish to be pre-approved, our professional agents has instant access to help you financial home loan services the best prices, even from your lender.

Exactly what ought not to I actually do in the event that I am hoping to get home financing pre-recognition?

Inside the time we should apply for a beneficial pre-acceptance, and up to your residence pick are finalized, there are some things to prevent to help be certain that lenders are on board:

Pre-qualify otherwise pre-approve? We enable it to be possible for you to definitely cut a heap off cash.

I simply take an elaborate home loan process and work out it easy, in unnecessary suggests. Our volume disregard form you’re going to get your very best rate to save you thousands (more than $3,000 typically). All of our stress-totally free techniques and also in-breadth financial education mode your questions is responded, plus info are performed proper.

Along with, when you connect with us, you’ll enjoy a reliable matchmaking and high advice whenever you you would like it, today and the next home loan requires. Listed below are some just what all of our members must say about their ideal mortgage provider.