When selecting or offering property, there are numerous parameters for all people to take on. Purchase price, settlement costs, and you will loan terms are typically the key settlement activities. Many consumers and you will providers was clueless that they’ll have the option to prevent some money fears by the offered an assumable mortgage.

Knowledge Assumable Fund

Assumable funds ensure it is homebuyers for taking over the earlier customer’s mortgage and finish investing it off depending on the modern terms and conditions. Specific antique mortgages provides a clause that allows these to getting assumed, but this can be far less well-known.

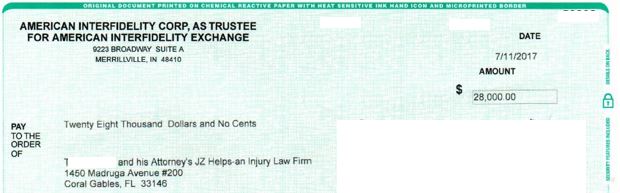

Whenever releasing a keen assumable financing, the brand new client need to pay the seller an up-front side swelling-sum count equivalent to the amount of equity they actually have home. In cases where the seller enjoys a minimal amount of guarantee, this might end in a considerably down very first resource. On the other hand, when there is a great number of collateral at your home, the consumer should come up with a huge initially payment. It is wrapped in dollars otherwise the second mortgage.

FHA finance that have exclusive loan day ahead of December 1, 1986, was subject to what is labeled as a simple Presumption Process. This is basically the proper way to assume financing since the zero bank approval or credit assessment is necessary.

To assume that loan that originated after this time, buyers must undergo a great Creditworthiness Expectation Processes. This involves them to meet the latest requirements needed to be considered having another FHA financing and located financial acceptance.

Buyers looking to assume a good Virtual assistant loan need to have a resource money and a fair credit rating. They need to plus shell out a fee off 0.50% of brand new principal. In case the brand spanking new financing big date try just after February step one, 1988, both the financial and the Va must commit to the assumption before it may seem.

When the rates of your own brand-new financing is actually below the brand new current readily available Annual percentage rate or other words become more good, of course, if the first loan might be a critical advantage towards visitors. In many cases, it’s also possible to manage to prevent settlement costs and you can/or appraisal costs.

Occasionally, consumers may be able to dominate an excellent Va loan, that’s partly paid by regulators, instead of indeed are an experienced.

To have manufacturers, an enthusiastic assumable financing with great terms will likely be a confident attempting to sell section. This might enables you to ask for a high price and tends to make your residence more attractive than an equivalent checklist instead of a keen assumable loan solution.

To have a supplier who’s having problems and then make home loan repayments, getting the buyer suppose the loan enables you to get out of less than it as opposed to refinancing or defaulting. It ageing their borrowing from the bank with a foreclosure.

The key problem one buyers stumble on is the fact there is certainly no collection of lender. You must imagine the borrowed funds regarding the seller’s completely new financial. If you are not recognized South Dakota loans, there is no need any kind of financial support choices.

While the a seller, you ought to always stick to the procedure just and you can found a formal discharge of responsibility on financing. Otherwise, you can be kept accountable in case the the fresh customer non-payments.

Providers who allow Va loans is believed should be aware of you to definitely in most cases you cannot rating a different sort of Va mortgage up until new customer takes care of the original mortgage. In the event the the latest buyer non-payments, this may impression your ability to use the new entitlement for future family instructions.

Regardless if you are buying or selling a home, it’s wise to inquire if financing expectation try an option. Carefully comment the loan terms and you may consider carefully your private affairs so you can determine whether these types of financing can be right for the situation.

If you purchase a product or sign up for an account courtesy a connection with the our very own site, we could possibly found settlement. Utilizing this website, your accept the Associate Contract and you can agree that your own ticks, connections, and personal information is generally obtained, submitted, and/otherwise kept by you and you may social network or other third-group lovers in accordance with all of our Privacy policy.

Disclaimer

Entry to and you can/otherwise registration towards any percentage of your website comprises invited of the Member Contract, (updated 8/1/2024) and acknowledgement of your Privacy policy, along with your Privacy Alternatives and you will Legal rights (up-to-date eight/1/2024).

2024 Get better Local Mass media LLC. The legal rights set aside (Throughout the United states). The information presented on this web site might not be reproduced, marketed, transmitted, cached or else put, but to the earlier in the day written permission of Get better Regional.